Authors:

Historic Era: Era 8: The Great Depression and World War II (1929-1945)

Historic Theme:

Subject:

Spring 2023 | Volume 68, Issue 2

Authors: John Steele Gordon

Historic Era: Era 8: The Great Depression and World War II (1929-1945)

Historic Theme:

Subject:

Spring 2023 | Volume 68, Issue 2

The recent failures of Silicon Valley Bank and Signature Bank were shocking, but shouldn’t surprise. Even a quick look at banking history reveals that failures are as American as apple pie. Some 565 banks have closed since 2000, according to the FDIC, and over a thousand saving and loans failed during the crisis of the 1980s and early 1990s.

In 2018, Congress removed bank regulations that were put in place in the wake of the financial crisis of 2007-8. These regulations had required banks to undergo annual “stress tests” to assess their resiliency in scenarios such as rising interest rates, to maintain adequate levels of capital and liquidity to meet obligations in the event of unforeseen circumstances.

Silicon Valley Bank was an institution focused on providing loans and services to earlier-stage high tech companies. Presumably their officers were able to read balance sheets, but they failed to appropriately vet their own risk portfolio. Greg Becker, the bank’s CEO, was one of the executives who successfully lobbied Congress for the relaxing the regulations.

Despite the need to maintain an impeccable reputation, bankers are human. They are sometimes too agreeable to their friends, sometimes too optimistic, or too greedy, or dishonest. Once someone possesses the magic power to create money, the temptation to create too much is very strong. That’s why banks need constant watching.

And never forget that banks are in the money business. That’s why Willie Sutton robbed them. That’s why politicians want the bankers on their side and are thus predisposed to favor the bankers over the banking system.

The first American failure took place in Rhode Island in 1809, when a bank capitalized at forty-five dollars issued eight hundred thousand dollars in bank notes, a sum equal to more than seventeen thousand times the resources behind it.

The two centuries since then have been marked by literally tens of thousands of bank failures in the U.S. In sharp contrast, Great Britain, whence most of American banking theory and practice comes, has had only a handful of major bank failures in over a hundred years.

Why should the richest and most productive capitalist economy on earth have such a dismal record in safeguarding a system so central to capitalism? The answer lies in the peculiar nature of the business we call banking, in our national history as a federal republic of sovereign states, and in our politics.

While no one could dispute that our Constitution and our politics have been, on the whole, a triumphant success, American banking is perhaps the ultimate proof of Sir Winston Churchill’s contention that “democracy

Banks are in the money business, and that, ipso facto, makes banking a very peculiar business indeed. Cash on hand, for instance, is an asset in most enterprises; it is usually a liability to a bank because it is owed to the depositors. Loans, on the other hand, are assets because they are owed to the bank. If an ordinary business goes broke, it is a financial problem for the owners, the employees, and the creditors, who, usually being professionals, have no one to blame but themselves. When a bank goes broke, however, it can affect the personal economic well-being of nearly everyone in the community or even, if the bank is large enough, the entire country.

And bankers, unlike other businessmen, must always serve two masters. Depositors want safety, borrowers want easy credit. Treading the delicate line between these two largely incompatible demands has been the very essence of successful banking.

Because banks are in the money business, we need first to answer the question, What is money? As is often the case with questions that seem obvious, the answer is not quite so obvious. That piece of expensive, beautifully engraved paper in your pocket, the one with the portrait of George Washington on the front, is, certainly, money.

But what makes it so? A dollar bill is in itself nearly worthless, except perhaps to someone in the market for an engraving of our first President. It has no intrinsic value, as gold and silver coins do. Nor does it represent something of value on deposit somewhere. To be sure, the government says it is money, or at least “legal tender.” The Confederate government, however, said its dollar bills were money, and no one believed it, with disastrous consequences for the Confederacy.

But you can take a U.S. dollar bill and go into the marketplace, where anyone will happily exchange one dollar’s worth of goods for it. Why? Because people have every confidence that they, in turn, can take it into the marketplace at a later date and exchange it for goods of equal value. It is this characteristic, and this alone, that makes it money. To state it formally, money is any commodity that is readily accepted in the marketplace in exchange for every commodity.

Many things have served as money at different times and different places. The famous stone coins of Yap Island in the Pacific, which weigh several hundred pounds apiece, are one example. American cigarettes in immediate postwar Europe are another. Before banks, Western

Today most money has no material existence at all but rather is nothing more than elaborate on-and-off patterns of microscopic electric switches deep in the bowels of vast computer networks. Regardless, as long as you can take your Visa card and use it to buy whatever you want, those blips are money.

As I said, banks are in the money business. They safeguard it, they lend it, and, most important, they create it. The easiest way to understand what a bank does is by looking at the earliest history of modern banking in Britain (oversimplifying considerably).

The first English bankers were the goldsmiths of Elizabethan and Jacobean times. By the nature of their business, they had to keep a supply of precious metals — that is, money — on hand to fulfill orders. Sometimes they had more than they needed at the moment, and the goldsmiths began lending out this surplus money, at interest, to people who could give satisfactory collateral, such as goods or land.

Also, given the value of the materials they worked with, the goldsmiths necessarily were expert at safeguarding valuables. People who had surplus gold and silver of their own began leaving it with goldsmiths for safekeeping, and the smiths would in turn give them receipts.

It was at this point that one of the great inventions of the modern era appeared, its inventors forever nameless: paper money. People began accepting the goldsmiths’ receipts in the marketplace instead of the valuables those receipts represented. In other words, the receipts, soon called bank notes, became money.

It did not take the goldsmiths very long to notice this or to take the next logical step. If the receipts were used as money, why not issue receipts, instead of the gold itself, when making a loan? This they proceeded to do, and here a very strange thing happened. By issuing receipts when making a loan, the goldsmiths created money out of thin air. The precious metal in the goldsmiths’ vaults remained, of course, money. But the receipts they issued in its stead were also money. The goldsmiths had become bankers.

There was one big problem. The receipts remained money only so long as everyone in the marketplace believed in them or, more precisely, in the banker. As long as people believed that the goldsmith would exchange his paper for gold at any time, all was well. But if that belief, for whatever reason, began to crumble, disaster for the banker, for his depositors, and for his borrowers lay straight ahead.

The reason is simple. When the banker issued receipts instead of gold in making a loan, there came to be more receipts than there was gold

A loss of faith by the marketplace, therefore, is every banker’s nightmare. For this reason bankers, far more than other businessmen, have had to guard their reputations zealously. As Walter Bagehot explained more than a century ago in his masterly study of British banking, Lombard Street, “Every banker knows that if he has to prove that he is worthy of credit, however good may be his arguments, in fact his credit is gone.”

The most important way bankers have guarded their reputations is to keep adequate reserves, money in the vault ready to meet any demand for withdrawal. As long as everyone asking for his money receives it promptly and courteously, no one is likely to doubt the bank’s solvency.

But despite the overwhelming need to maintain an impeccable reputation, bankers are human. They are sometimes too agreeable to their friends, sometimes too optimistic, or too greedy, or dishonest. Once someone possesses the magic power to create money, the temptation to create too much is very strong. That’s why banks need constant watching. Banks are too important to be left to bankers.

And never forget that banks are in the money business. That’s why Willie Sutton robbed them. That’s why politicians want the bankers on their side and are thus predisposed to favor the bankers over the banking system.

In Britain the Bank of England, founded in the late seventeenth century, evolved in the eighteenth century into a “central bank,” a watchdog institution insulated from politics, with the power to regulate all British banks and thus protect what is, properly cared for, a great national asset: the power to create money.

By setting reserve requirements and capital minimums, a central bank has the power to control how much money the banks create and thus influence the business cycle. The United States has spent over two hundred years trying to develop a similarly effective watchdog. The SVB disaster is the expensive proof that we have not yet succeeded.

There were no banks in colonial America, first because Britain forbade their establishment and second because the Colonies, which operated largely with a barter economy, had hardly any gold or silver in circulation on which to base a bank. With independence, a few banks were chartered by states, first in Pennsylvania in 1782

Today these would be called commercial banks. They accepted “demand deposits” from merchants and businessmen (that is, they agreed to return the money to the depositor at any time he wanted it). And they issued bank notes in order to make demand or short-term loans to the same merchants, allowing them to finance inventories and accounts receivable. This form of bank evolved into today’s so-called full-service banks, many of them giant institutions such as the Bank of America, Citicorp, and JPMorgan Chase.

These first banks had corporate charters from state governments, but soon private banks arose as well. These often performed exactly the same function as commercial banks, but holding no charters from the states, they were structured as partnerships. The potential liability of each partner was unlimited. This uncomfortable fact has always made private bankers notably cautious. Private banks never issued bank notes, as chartered banks could, but they were often large and powerful. The most influential bank in American history, J. P. Morgan and Company, was a private bank until the 1930s.

The first banks, chartered or private, were not interested in handling personal accounts or small accounts at all. Thus people of small or moderate means had no place to put their savings except under the mattress. In 1816, however, a new type of financial institution appeared in the United States, the mutual savings bank. The first one of all was the Philadelphia Saving Fund Society, which began operations on December 21 of that year. Unlike commercial banks, mutual banks are owned by the depositors. In the first mutuals, deposits were invested in government bonds, not loans, and all profits accrued to the depositors.

Obviously the mutual savings bank arrangement, in its initial form, was extremely safe, exactly suited to handling the savings of people of modest means who could not afford a loss. But actually it was not a bank at all. Because it did not issue bank notes or make loans, it created no money and thus in fact resembled a sort of government-bond mutual fund. Regardless, these operations soon evolved into banks. The chronic need for mortgages caused many state governments to give mutual savings institutions the power to make such loans.

By the end of the nineteenth century, there were nearly five hundred mutual savings banks, mostly in the Northeast, and they held nearly 50 percent of the money deposited in savings, or time, accounts. Savings accounts differed from regular accounts in that the bank could impose a waiting period, usually sixty days, before permitting withdrawal. By the end of the nineteenth century, commercial banks were also accepting savings deposits from individuals and making loans to them as

In 1831 a second type of “bank” for people of modest means came into existence in the United States—the savings and loan association. The S&L has been known over the years by many names, such as building society and cooperative bank, but has always had the same purpose. Originally a set number of people would gather and agree to put up a sum of money every month until a certain total was achieved. When the total was reached, it was loaned to one of the members to build a house. When every member of the society had built a house, the society was dissolved.

The first S&L in the country, the Oxford-Provident Association of Frankford, Pennsylvania, was this type of institution and dissolved after ten years, its mission accomplished. But before long S&Ls, too, evolved into permanent organizations, providing a place for small savers in the community to keep their money and helping finance the housing of these same people.

In other words, they became banks. In fact, it has been a pronounced tendency of financial institutions, whether they be savings societies, building associations, insurance companies, trust companies, or brokerage houses, to evolve toward being full-service banks. Everyone, it seems, wants the power to create money.

The idea of the savings and loan institution, serving local savers and homeowners, caught on quickly. By the end of the 1920s there were more than eleven thousand throughout the country. As long as savings and loan institutions remained small and local, and the management, the depositors, and the borrowers all lived in the same community and knew one another, they worked well and helped fill a real need.

But the banker’s nightmare was always a particular problem for S&Ls. Real estate loans in the form of single-family mortgages are, necessarily, long-term loans and can be difficult to convert into cash in times of financial stress. The assets of S&Ls, therefore, were illiquid. If the depositors panicked, there was no way even a basically sound S&L could pay them their money and avoid failure.

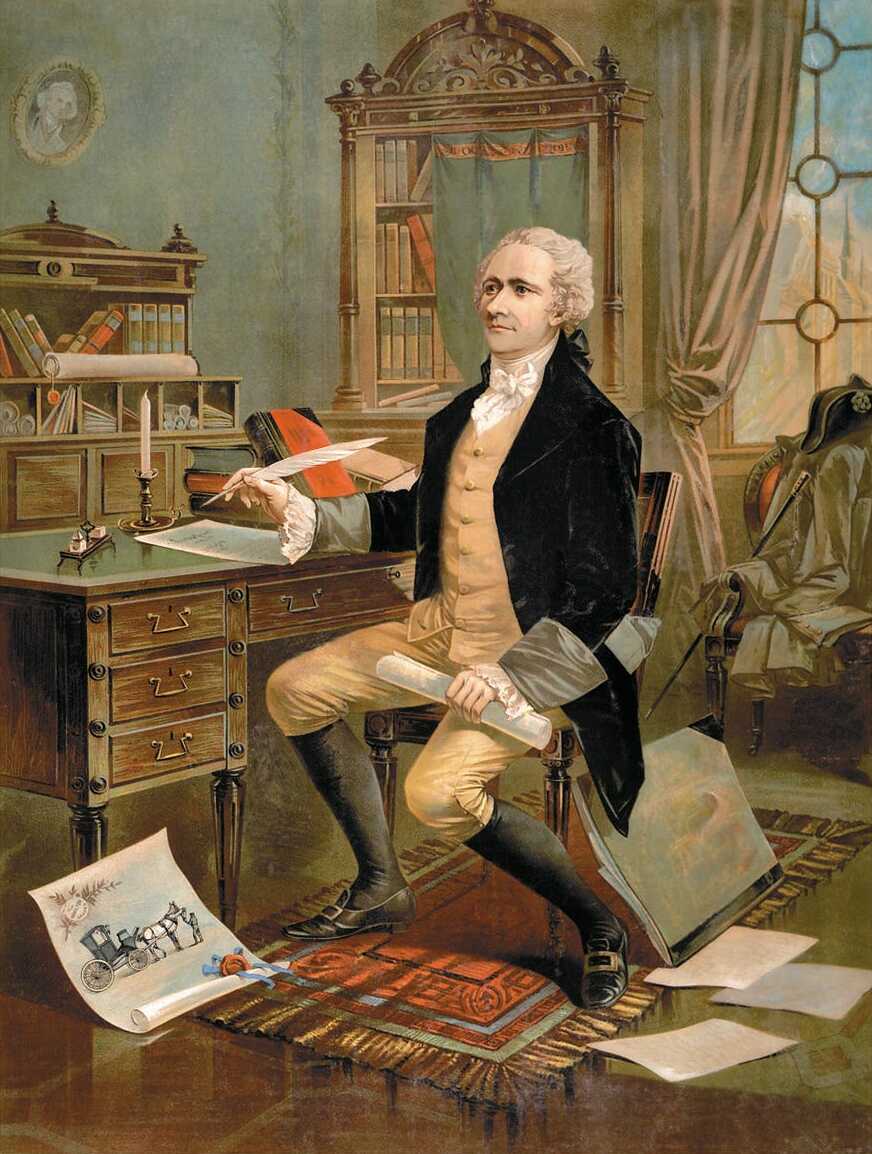

When the new Constitution came into force in 1789, Alexander Hamilton, the first Secretary of the Treasury, quickly established the first American banking system. Its apex was the federally chartered Bank of the United States, modeled on the Bank of England. The new bank was intended to act as the fiscal agent of the government and could thus discipline other banks by refusing to accept their bank notes in payment of taxes if it doubted the banks’ solvency. If the Bank of the United States didn’t accept a bank’s paper, no one else would either, and the bank would be out of business. This forced the early banks to be prudent,

Hamilton’s plan, however, aroused intense opposition, led by Thomas Jefferson. Jefferson harbored a fierce, almost visceral hatred of banks, a hatred that grew in direct proportion to a bank’s size. Jefferson transmitted this passion to his political heirs. Laws designed to keep banks small, if not nonexistent, proliferated.

Many states, for instance, limited or forbade branching. A feature of the American economy ever since, this has had no small consequences by forcing the creation of thousands of independent or so-called unit banks. Even today, with only about 40 percent as many banks as in the early 1920s, the United States still has at least ten times as many banks as all the other industrialized countries put together. Great Britain gets along with just thirteen commercial banks.

The number of American banks expanded steadily under Hamilton’s system. When the Bank of the United States was established in 1791, there were only three other banks in the country. Twenty years later there were nearly two hundred and fifty. While Hamilton’s national bank effectively influenced other banks with its power to refuse particular bank notes in payment of federal taxes, it was each state that chartered, regulated, and audited all the other banks, with widely varying degrees of zeal and competence.

Missouri and Indiana, for instance, each had a single, state-owned, many-branched central bank, a system that worked well. Louisiana had a system of closely regulated commercial banks and a national reputation for sound banking. Illinois and Michigan, on the other hand, had banking systems notorious for flimflam, fraud, and failure.

At first every bank charter required a special act of legislation, and politics played a large part in who obtained charters and who did not. Aaron Burr, for instance, had to sneak a clause into a charter for what was supposed to be a water company in order to found what would in time become the Chase Manhattan Bank.

In 1837 the principle of free banking was established, first in Michigan and the following year in New York State, and it quickly spread. Under free banking a new bank had only to fulfill basic requirements set by the law in order to enter the banking business. Personal politics was driven out of banking by the new system, but interest-group politics certainly was not. Because there have always been so many banks in this country, the banking industry has been a strong, often too strong, voice in the political process.

Hamilton’s bank lost its struggle to have its national charter renewed in 1811 and became an ordinary state bank, chartered by New York. Although a second national bank

In the years after Jackson, therefore, the nation’s money supply was determined entirely by a Hydra-headed system of hundreds of independent banks, regulated both well and badly by more and more state governments as the Union expanded. A steady tattoo of local bank failures, punctuated by occasional national financial panics, was the inevitable result.

With discipline much loosened by the decline and fall of central banking in the United States, banks, and bad banking, proliferated. By 1840 there were a thousand banks in operation in the United States; twenty years later the number had nearly doubled. But almost half the banks founded between 1810 and 1820 failed before 1825. A similar percentage of those founded in the 1830s failed before 1845.

Although the first English banks were born because people had money to lend, America’s completely undeveloped economy reversed the impetus to bank formation. As early as 1857 one observer noted that “it has become proverbial that banks never originate with those who have money to lend, but with those who wish to borrow.” This was true even as early as Aaron Burr’s day. Three years after Burr founded his bank, he owed it $64,903.63, a fortune.

Part of the rapid spread of banks was due to the fact that the new United States was growing with enormous speed, and swift economic growth is always a messy business. In the seventy-three years between the adoption of the Constitution and the outbreak of the Civil War, the nation’s territory tripled and its population increased eightfold. The economic output of the country (today we would call it the GNP) multiplied eighteen times and its money supply no less than forty times, from $15 million to $600 million. Only 25 percent of this money supply, however, was in the form of gold and silver. The rest was in deposits and bank notes.

The banks in the older Eastern cities were, not surprisingly, the largest and most conservative, and the Eastern states in general had the toughest banking laws. The Eastern banks issued the least paper money, relative to their capital; many issued none at all.

Rather it was the banks located in the frontier regions of the country, where the demand for credit was greatest and the need for banks’ magical ability to create money the most intense, that

Some “banks” were deliberate frauds from the very beginning, their sole purpose being to issue as many notes as possible, get as much for them as possible, and then disappear. These were known as wildcat banks, because their headquarters were invariably located “out among the wildcats,” where they were hard to find. Florida authorities reported that they could find no local trace of one bank, chartered by the state in 1835, but added brightly that “it is said [to be] chiefly operating in New York.” Some states were not above aiding and abetting this practice. Nebraska, for instance, forbade banks chartered in that state to issue bank notes there but allowed Nebraska banks to issue them in Iowa. Iowa returned the compliment.

Nothing could show more clearly the regulatory anarchy that was American banking in the early years. The Constitution had made the United States a single common market, but the Jeffersonian inheritance made it nearly impossible to effectively regulate banks, through which the lifeblood of the American economy increasingly ran as we evolved from an agricultural, barter-based economy to an industrial, cash-based one.

Perhaps underlying Churchill’s famous backhanded compliment to democracy is the fact that true reform, however obviously desirable or even necessary, can often be achieved only during or after a great crisis. The American Civil War certainly qualified as a crisis and placed wholly unprecedented demands on the American economy and money supply.

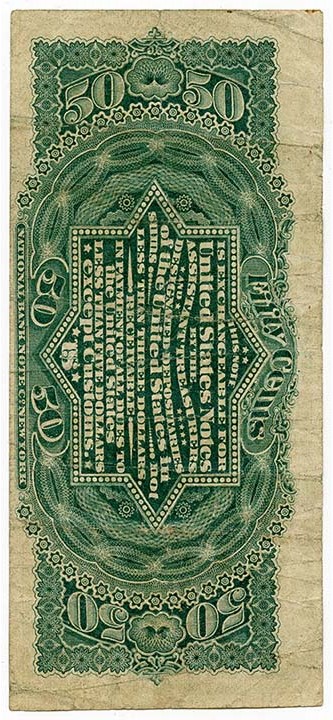

The cost of the war forced the government (and the banks) off the gold standard — that is, they had to stop paying their bills in gold. The government began using printing-press money, the so-called greenbacks authorized in early 1862. Greenbacks were the first paper money the United States government had ever issued. (Salmon P. Chase, Secretary of the Treasury and a chronic presidential hopeful, took advantage of a golden opportunity for publicity by placing his own face on the one-dollar greenback.)

The value of greenbacks fluctuated relative to gold according to the fortunes of the Union Army. Just before Gettysburg it took $283 in greenbacks to buy $100 worth of gold. More than $400 million in greenbacks would be issued by 1863, and this great increase in the money supply drove the wartime inflation. But at least one could determine the value of the greenbacks at any time by looking in the newspaper. And the

Far more important to the American banking industry than greenbacks, however, was the establishment in 1863 of a national banking system. It was designed both to help finance the war and to reform American banking. It succeeded admirably in its first goal but only partially in its second.

The legislation called for the creation of nationally chartered banks. These banks had to have at least fifty thousand dollars in capital, a relatively large sum in those days, of which thirty thousand dollars had to be invested in U.S. Treasury securities. They could issue bank notes, but only those designed and engraved under the direction of the federal government, and these notes had to be backed by pledged Treasury bonds.

The first national bank was chartered on June 20, 1863, in Philadelphia. (One can only wonder if it is pure coincidence that Pennsylvania was the home to the first commercial bank, the first central bank, the first mutual savings bank, the first S&L, and the first national bank in the country.) It had been expected that the major state banks would switch over to national charters, but they were reluctant at first. By November 1863 only 134 national banks had been chartered, almost all of them new banks.

Changes in the law in 1864 sped conversions, but they still were undertaken by only a small fraction of the old state banks. So in March 1865 Congress passed a prohibitive 10 percent tax on bank notes issued by state-chartered banks. This was designed not to raise revenue but to force the state banks to take national charters. “The national banks were intended to supersede the state banks,” Sen. John Sherman, architect of the legislation, reported. “Both cannot exist together.”

By 1866 there were more than sixteen hundred national banks; some two hundred state banks remained outside the system. Also outside the system, of course, were mutual savings banks, private banks, and S&Ls.

The comptroller of the currency, an officer in the Treasury Department, was responsible for regulating the national banks and quickly developed stringent standards, instituting such practices as unannounced visits by bank examiners, to keep the bankers on the straight and narrow. State banking departments began to adopt such ideas as well, and the number of bank failures caused by fraud quickly tumbled. The days of wildcat banking were over.

In the first seven years of the national banking system, there were only fifteen failures among national banks. That was still far too many, but it was much fewer than had been the norm in the 1850s. As the regulatory system became increasingly effective, the number of failures continued to decrease.

The national banking system worked very well in the Northeast, but the defeated South, its liquid capital destroyed, had fewer than a hundred national banks, and none in Mississippi or Florida,

This last restriction was intended to ensure the liquidity of national banks, whose deposits were mostly demand, but it infuriated those two regions, which were more than happy to transfer their Jeffersonian hatred of banks to the new national banking system. The number of banks in the state systems, which had much lower capital and reserve requirements, began to grow again and soon surpassed that of the national banks, although their total assets remained far smaller.

The loss of the power to issue bank notes, which, it had been thought, would kill state banking, turned out not to be vital anymore. Instead bankers created money simply by crediting the borrower’s balance in a checking account (a British invention). Their power to create money was unimpaired. Still, for the first time in its history, the United States had a uniform paper currency that was soundly backed and very difficult to counterfeit. The national bank notes were accepted as money from the beginning throughout the country, and they ended, at last, the currency chaos.

Thanks to the Jeffersonian inheritance, the national banks were forbidden to branch or operate across state lines, so the number of national banks grew quickly. There were 2,000 banks in the United States in 1866. By the turn of the century, there were 3,731 national banks and 4,405 state banks.

The average bank size, however, was no larger, about five hundred thousand dollars in assets, than it had been thirty-four years earlier. Even the largest New York banks had only about thirty to forty million dollars in assets, nearly the same amount as in 1870.

After 1900, however, a divergence in American banking occurred. The country banks remained very small and grew ever more numerous (there were 30,000 by 1920), but the city banks mushroomed. By the 1920s New York’s First National City Bank (the forerunner of today’s Citibank) reached a billion dollars in assets.

In 1907 a great banking panic swept the nation, and the federal government, lacking any means to deal with it, had to call on J. P. Morgan to rescue American banking. Thanks to the crisis, however, the country finally acquired a central bank, the Federal Reserve System, in 1913. All national banks were required to be members of the Federal Reserve, and state banks that could meet the capital requirements (most could not) could join as well.

The Federal Reserve stood ready to provide member banks with its bank notes

This was the great advantage of being a member. The great disadvantages of membership were the new stringent capital and reserve requirements. The practical effect, unfortunately, was that strong banks joined the system and weak ones, which most needed the protection, did not.

Although the Federal Reserve was given the power to regulate some aspects of the national banks’ operations, the comptroller of the currency continued to regulate others. The reason for this absurdity lay in the intricate political negotiations that had been necessary to get the Federal Reserve created in the first place. Jefferson’s hatred and fear of Hamilton’s old Bank of the United States was still exerting its malignant influence a hundred years after Jefferson’s bucolic vision of America had begun to vanish.

And, while the Fed itself was insulated from politics, the dual banking system, with some banks under state regulation and the others under federal, positively invited political intervention. Interested parties manipulated state and federal governments one against the other to further their own interests, while the two systems competed for influence in the banking business. Although American banking history showed the need for discipline provided by a central bank, it would be 1980 before all commercial banks were required to adhere to the Federal Reserve requirements regarding minimum reserves and capital.

Still, for all its faults, it was by far the best banking system the country had ever had. After the First World War, however, the system unraveled. From the late 1890s until 1919, American agriculture and small-town life flourished as never before or since, and small-town banks flourished too. In 1921 there were 29,788 commercial banks in the country, the overwhelming majority of them state-chartered, one-branch institutions with assets under a million dollars. But agriculture suffered greatly in the recession that followed the First World War and did not share in the prosperity of the 1920s. This, of course, adversely affected the small-town banks dependent on making agricultural loans.

Further, the automobile began to allow people far more mobility. They could shop — and bank — much farther afield. The small-town banks, losing their local deposit monopolies on one side of the ledger and their loan business on the other, began swiftly to decline and then to fail. There were, on average, more than 550 bank failures a year in the United States in the 1920s, most of them in small towns.

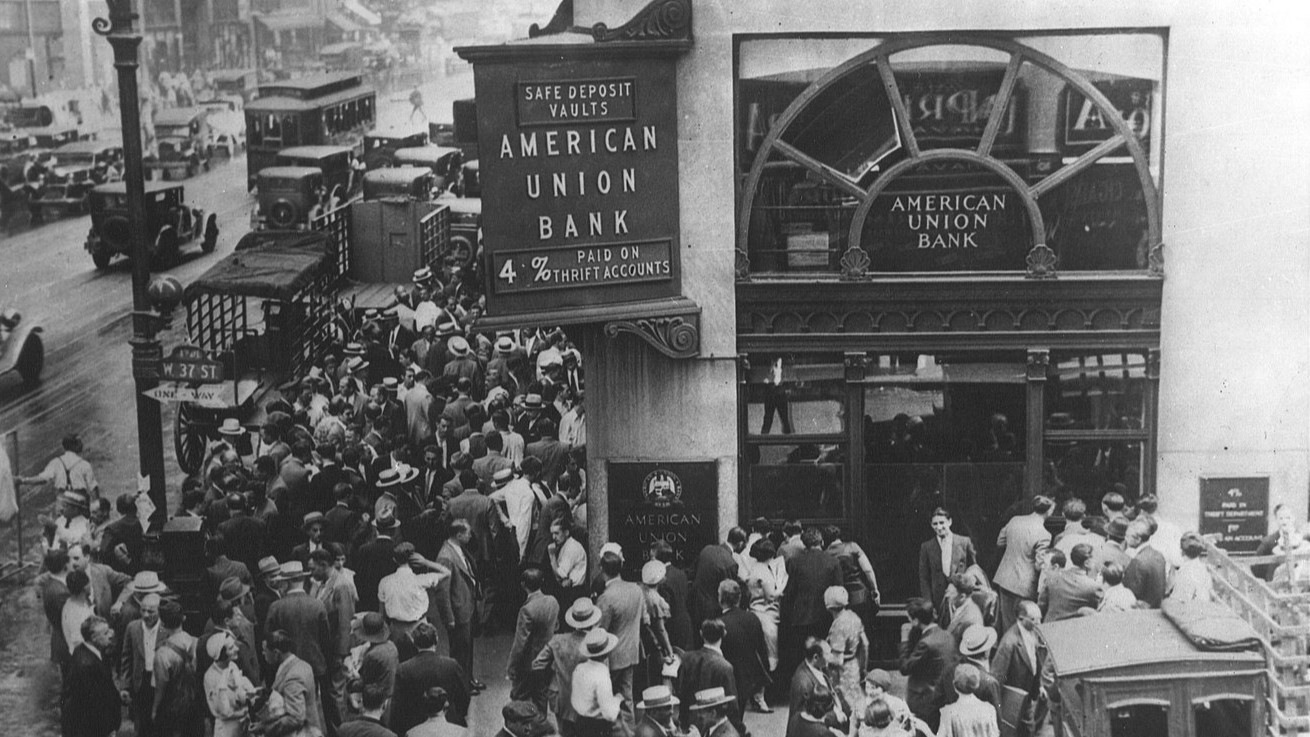

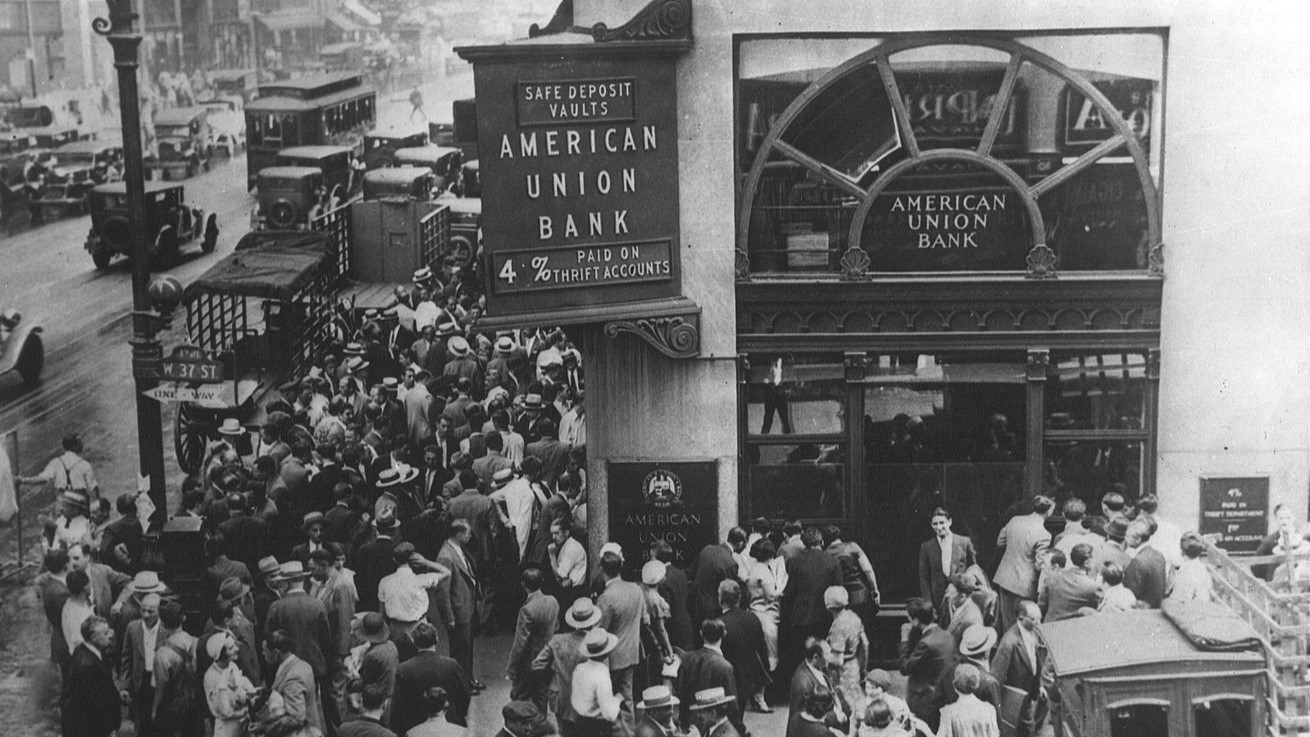

The steady stream of bank failures in the 1920s turned into a torrent with the start of the Great Depression. More than 1,300 banks collapsed in 1930; more than 2,000 in 1931. In

Virtually the first act of the new Roosevelt administration was to close the banks and stop what was rapidly becoming a nationwide panic. Sound banks were allowed to reopen in a few days, and once they had been examined and declared healthy by the government, people trusted them once again and deposits flowed back into the system. It had been a near thing, but the Ameriran banking system had survived.

Again, it took a grave crisis to achieve real reform. The Federal Reserve System was reorganized and given broad new powers to regulate money and credit. The restrictions on what the Fed could take as collateral were removed, and it became much more effective as a lender of last resort. The national bank notes disappeared, and finally only the U.S. government was allowed to print money.

The most important reform for everyday banking was the formation of the FDIC (the Federal Deposit Insurance Corporation) in 1933 and the FSLIC (the Federal Savings and Loan Insurance Corporation) the following year. These government corporations insured bank deposits in case of failure. By doing so, they removed any reason for depositors to panic and suddenly withdraw their funds. The idea had been around for a long time (New York State had been the first to institute deposit insurance, in 1829), and several states had instituted their own insurance plans in the late nineteenth century. But these had folded up one by one as the small-town banks began failing in large number in the 1920s.

President Roosevelt was himself none too keen on the idea of deposit insurance because he saw very clearly the fatal flaw. What had always been the most powerful impetus to sound banking since the days of the goldsmiths had been the need of the bankers to retain the trust of their depositors. “We do not wish to make the United States government liable for the mistakes and errors of individual banks,” Roosevelt said, “and put a premium on unsound banking in the future.” The 1980s would prove Roosevelt’s fears well founded.

Still, as originally designed, the insurance system was funded by the banks themselves and protected individuals’ deposits only up to twenty-five hundred dollars, less than twice the average annual household income in 1934.

Also, banks that joined the system had to submit to

For the first time nearly all commercial banks in the country were being held to uniform rules—those of the FDIC. But the FDIC was a third layer in the federal regulatory framework, added to the comptroller of the currency and the Federal Reserve. Worse, S&Ls could now get federal charters as well as state ones, and those that did came under the regulation of both the FSLIC and the Federal Home Loan Bank Board (FHLBB). In addition, the Federal Housing Authority began to issue mortgage insurance and, of course, detailed regulations. It was a regulatory tangle only a bureaucrat—or someone bent on manipulating the system--could love.

The final reform of the 1930s was to establish, in effect, a government-sponsored banking cartel. Commercial banks, savings banks, and savings and loan banks carved up the banking business among themselves. Commercial banks became full-service banks, offering both checking and savings accounts and consumer loans to individuals while continuing their business banking. Mutual savings banks and S&Ls offered savings accounts and made local real estate mortgages. The former specialized in commercial real estate, the S&Ls almost exclusively in single-family houses.

The number of new charters was closely regulated to prevent “excess competition.” For instance, while the assets of S&Ls grew in the twenty years from 1945 to 1965 from $8.7 billion to $110.4 billion, the number of S&Ls remained steady at the slightly more than six thousand that had survived the debacle of the early 1930s.

With the Second World War, prosperity returned both to the country and to the banking system. The Federal Reserve was able to keep interest rates remarkably steady for a quarter of a century, and this allowed the interest rates paid on individual accounts to be steady. When an uptick in inflation in the early 1960s threatened to raise the interest paid by banks to their depositors, Congress quickly fixed maximum interest rates. Lacking the allure of checking accounts, savings banks and S&Ls were allowed to pay one-quarter percent more than full-service banks on savings.

Had the banks arranged such a thing among themselves, it would have been called price-fixing and a combination in restraint of trade. Because it was done by Congress, it was perfectly legal. But the effect, of course, was to insulate the banks from the signals of the marketplace, and American banks began to lag noticeably behind banks in Europe and Japan in technical innovation.

It was a very cozy arrangement for everyone in

Then Lyndon Johnson tried to fund a war and a massive social program at the same time, and inflation grew. Richard Nixon severed the close connection between gold and the dollar, and inflation took off. Unregulated interest rates rose sharply, while the legal interest rates that could be paid by banks to depositors remained unchanged.

Had that been all, then average citizens would have had no choice but to keep their money in banks and suffer accordingly from the price-fixing, anticompetitive banking system crafted in the 1930s. But that was not all. Wall Street brokerage houses and mutual funds began moving aggressively to acquire the little guy’s capital with something called the money market fund. The interest paid by money market funds was not regulated and thus was far higher than could be offered by banks. People thronged to the new funds, withdrawing their savings from banks in ever-greater amounts.

This deposit flow from low-paying savings accounts to high-paying money market accounts was given the wonderfully sonorous technical name of disintermediation. Sonorous or not, it was a mortal threat to savings banks and S&Ls. Commercial banks could cope with disintermediation. Demand deposits carried no interest anyway, and savings deposits were an important but not vital part of their deposit base. Much of their loan portfolios were short-term. But the savings bankers, faced with a rapid decline in deposits while holding long-term loans at low, fixed interest rates, went to the federal government for help.

Politicians fairly rushed to their aid. It is not hard to see why. As Sen. David H. Pryor of Arkansas explained at the time, “You got to remember that each community has a savings and loan; some have two; some have four, and each of them has seven or eight board members. They own the Chevy dealership and the shoe store. And when we saw these people, we said, gosh, these are the people who are building the homes for people, these are the people who represent a dream that has worked in this country.” These were also, of course, the very sort of people that politicians most want the support of.

It was a fateful congruence of interests. In truth, mutual savings banks had become obsolescent by the turn of the century, after commercial banks had begun offering services to ordinary citizens. The

Had the integrity of the American banking system as a whole been Washington’s primary concern, banks too weak in capital and assets to survive on their own in the new financial marketplace would have been merged with stronger commercial banks. Other mutuals and S&Ls would have become commercial banks on their own, with the same capital and reserve requirements as all other commercial banks.

But because the banking lobby’s influence with politicians had always been extremely strong, it was the interest of bankers, not the banking system or even the Republic itself, that came first. The presidents of the 4,613 S&Ls in business in 1980 wanted to continue being bank presidents. The Chevy dealers and shoe-store owners on the boards of those S&Ls wanted to go on being bank directors. A series of quick fixes for the S&Ls ensued, rather than a basic restructuring of the industry.

In 1790, when Alexander Hamilton submitted to Congress his “Report on a National Bank,” his plan for establishing the American banking system, he had cogently argued the folly of allowing politicians anywhere near the power to create money that is inherent in banking. The 1980s were to prove why Hamilton had been so very right.

In 1980 Congress removed the ceiling on the interest rates that bankers could pay and, while they were at it, raised the amount of the federal guarantee on deposits from forty thousand dollars to one hundred thousand. Had the federal guarantee simply tracked inflation since 1934, the guarantee would have amounted to slightly more than fifteen thousand dollars by 1980. Had it remained at the same multiple of average family income, it would have been slightly less than fifty thousand dollars. Raising it to one hundred thousand was not, therefore, done to protect widows and orphans. It was done to help out the bankers.

Here’s how. As early as the 1960s Wall Street had been making what are called brokered deposits in thrift institutions. These deposits were made in amounts that matched the limit on the federal guarantee and were designed to allow the rich to have as much of their savings under that guarantee as they wished. It was, in other words, a way around the limit that should never have been tolerated by the government in the first place. The FHLBB, realizing that these brokered deposits were what is known as hot money — that is, money likely to chase the highest interest rates — had limited thrifts to holding no more than 5 percent of their deposits in this form.

In 1980, with the S&Ls desperate for deposits — any deposits — the FHLBB discreetly dropped this regulation, and hot money flowed into the once-staid S&Ls, now able to offer every capitalist’s dream: a high-interest, zero-risk investment. In order to attract this money, the S&Ls had to offer higher and higher interest rates on deposits as they competed among themselves for the new source of funds.

But the S&Ls had no way to earn the money to pay the high interest rates they were promising. They were still stuck with their old loan portfolios of low-paying, fixed-interest single family home mortgages. The result was not hard to predict: The S&L industry went broke. In 1980 the S&Ls had a collective net worth of $32.2 billion. By December 1982 it was $3.7 billion.

To remedy the consequences of the quick fixes of 1980, more quick fixes were now added. The FHLBB lowered the reserve requirements of S&Ls from 5 percent of assets to 3. “With the proverbial stroke of the pen,” wrote the journalist L. J. Davis, “sick thrifts were instantly returned to a state of ruddy health, while thrifts that only a moment before had been among the dead who walk were now reclassified as merely enfeebled.” The Bank Board also changed accounting requirements so that they, in effect, allowed S&Ls to show handsome profits when, in fact, they were fast becoming insolvent.

Still worse, they changed the rules on who could own thrifts. Instead of only people living in the community, now anyone could own a thrift. Latter-day Willie Suttons moved in. To make it easier for them to do so, the regulators now allowed non-cash assets — land, for instance, the most illiquid of all assets — to be used in making these purchases. Since the days of the goldsmiths and their surplus gold, bank capital had always been in the form of money or very near money such as U.S. Treasury bills. The one essential ingredient in the magic formula that allows bankers to create money had always been the banker’s own money. Now the regulators decided that title to ten thousand acres of Arizona desert would do nicely as well. It did not.

Also in 1982, Congress passed the Garn-St. Germain Act, which allowed the S&Ls to make nonresidential real estate loans and consumer loans up to 70 percent of their loan portfolios. In effect they became very nearly full-service banks, but with only a small fraction of the capital and reserve requirements of commercial

State regulators were forced to follow suit as state-chartered S&Ls pushed to join the federal system with its new freedoms. If they hadn’t, they soon would have found themselves with nothing left to regulate (and state politicians would have found themselves without the campaign contributions of the Chevy dealers and shoestore owners). California, which had the largest state S&L system by far, promptly upped the ante and allowed state-chartered thrifts to invest in whatever they pleased, from junk bonds to alternative energy schemes. California thrifts, in other words, became far more than full-service banks. They became venture capitalists. The only difference was that any losses were guaranteed by the government.

The S&L disaster was now unavoidable, for the politicians and the regulators they supervise had made three fundamental mistakes: (1) They had ignored all that three hundred years of history had taught about sound banking practices; (2) they had ignored the most intuitively obvious laws of economics; (3) they had forgotten what Willie Sutton and his ilk never forget—that banks are in the money business.

When they had done their work, they had created an economic oxymoron—the high-yield, no-risk investment called brokered deposits—that devoured the S&L industry, destroyed uncounted billions of American wealth, and wrecked an as-yet-uncounted number of political careers.

But at least the S&L crisis, a crisis that could have happened only in the American banking system, gives us the opportunity, once again, to make fundamental reforms. And that, in the last analysis, is why Churchill was a democrat for all of democracy’s foibles. Perhaps after two hundred years the American democratic process can at long last give the country a banking system that does not, in seeking to work the magic of creating money, periodically destroy wealth, as well.